AMBA: Strong Buy

- Moksh Vashisht

- 2 days ago

- 4 min read

Updated: 19 hours ago

Ambarella is a semiconductor design company focused on advanced image processing. It leads innovations in advanced driver systems, autonomous driving, and home security due to its deployment of edge AI. With faster data processing and analysis than data center AI, edge AI offers Ambarella a great advantage. Using the benefits of edge AI, Ambarella has mastered systems requiring real-time perception. This strength will catch the attention of consumers striving to improve driving systems and home security measures. Amberella’s early focus and subsequent success using edge AI solidifies their position as a strong-buy company

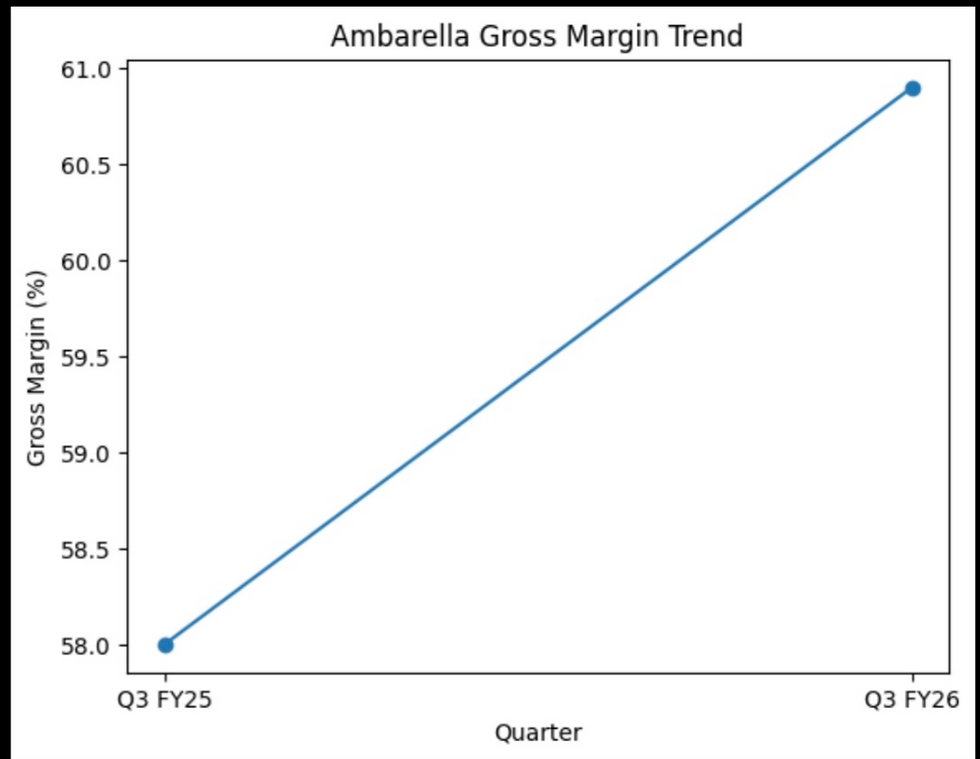

In Q3 of fiscal year 2026, Ambarella delivered another quarter of strong top-line performance, reporting record revenue of $108.5 million, up 31.2% year-over-year and exceeding both the prior guidance range and consensus expectations. This robust growth was accompanied by healthy profitability metrics, with non-GAAP earnings per share of $0.27 and a non-GAAP gross margin of approximately 60.9%, reflecting an improving product mix and solid execution. On the balance sheet, Ambarella strengthened its liquidity position, ending the quarter with about $295 million in cash, cash equivalents, and marketable securities and generating roughly $31.4 million in free cash flow, underscoring strong cash conversion alongside accelerating revenue. Management also raised FY26 revenue guidance to a 36–38% annual growth range, signaling confidence in continued demand momentum across edge AI and related segments. The return of operating leverage is increasingly evident as revenue growth outpaces expense growth: higher unit volumes, a rising mix of advanced AI-centric system-on-chips, and improving average selling prices have driven greater absorption of fixed costs and expanded margins, positioning Ambarella to scale more profitably while investing in strategic growth areas.

The total addressable market (TAM) for video surveillance and fleet telematics is large and expanding rapidly as commercial fleets adopt connected safety and analytics solutions. Grand View Research estimates the global video surveillance market at approximately $74 billion in 2024, with projected growth to nearly $147 billion by 2030 at a ~12% CAGR, driven by increased deployment of intelligent cameras, analytics software, and integrated monitoring systems across transportation and industrial use cases. Within this broader market, fleet video telematics represents a high-growth subsegment. Global Market Insights projects the video telematics market to grow from roughly $1.7 billion in 2024 to $8.7 billion by 2034, reflecting a ~18% CAGR fueled by safety regulations, rising accident costs, and demand for real-time operational visibility. A key driver of outsized growth is the increasing AI “attach rate”, as fleets move beyond basic GPS tracking to adopt AI-powered video analytics and driver monitoring capabilities. These AI features — including automated detection of distraction, fatigue, harsh events, and near-miss incidents — materially increase per-vehicle revenue by layering high-margin software and recurring services onto existing telematics hardware. As AI-enabled video becomes standard rather than optional, fleet video telematics is evolving into a core safety and risk-management platform, significantly expanding the monetization potential of the installed base.

For the robotics and industrial automation sector, Ambarella’s focus on real-time perception provides the foundational "vision" necessary for machines to move from static factory floors to dynamic, unstructured environments. As the robotic vision market heads toward a projected $6.27 billion valuation by 2030, the demand for high-performance 3D vision and autonomous navigation is skyrocketing. Ambarella’s CVflow® architecture addresses the three most critical bottlenecks in edge robotics: latency, power, and sensor density. By processing complex neural networks directly on-device with industry-leading performance-per-watt, their SoCs eliminate the delays of cloud processing and the thermal constraints of power-hungry competitors. Whether it is managing a 360-degree sensor suite for a mobile robot or providing the low-latency processing required for high-speed industrial bin picking, Ambarella’s silicon acts as the essential brain for the next generation of physical AI.

Ambarella’s Developer Zone (DevZone) is a centralized hub that gives developers and partners access to the tools, documentation, software stacks, and workflows needed to build and deploy edge AI applications on Ambarella SoCs. By lowering the barrier to entry and reducing time from evaluation to production, DevZone supports Ambarella’s strategy of powering physical AI beyond the data center, where success depends not only on silicon performance but on how quickly teams can integrate models into real-world systems.

DevZone also reinforces platform stickiness by embedding Ambarella’s software ecosystem deeply into OEM development cycles. Once customers adopt Ambarella’s SDKs, model deployment tools, and Cooper developer platform, switching to another vendor becomes costly due to retraining models, rebuilding pipelines, and revalidating systems. This integrated deployment environment, combined with support for mainstream ML frameworks and multi-sensor workloads, creates durable switching costs and positions Ambarella as a long-term platform rather than a component supplier.

Ambarella operates in a competitive edge-AI landscape but occupies a distinct “middle ground” position that differentiates it from both high-end and low-cost rivals.

On the high end, companies like NVIDIA, Qualcomm, and Mobileye offer extremely powerful AI platforms, but these solutions often come with high power consumption, higher costs, and greater system complexity. Such trade-offs make them less optimal for edge use cases that demand real-time perception under tight power and thermal constraints, such as cameras, drones, and industrial systems.

At the other end of the spectrum are low-cost camera SoC providers that prioritize affordability over AI capability. While suitable for basic imaging tasks, these chips lack the compute density and advanced vision processing required for modern AI-enabled perception workloads.

Ambarella sits between these two extremes. Its SoCs deliver strong AI inference and computer vision performance with industry-leading performance-per-watt, making them well suited for edge environments where efficiency, latency, and thermal limits matter most. This positioning allows Ambarella to compete effectively without chasing hyperscale-level compute, instead focusing on optimized, purpose-built edge AI solutions.

As edge AI adoption accelerates, this balanced strategy positions Ambarella as a differentiated and defensible player in the computer vision semiconductor market.

In a competitive positioning matrix comparing AI capability and power efficiency, Ambarella is positioned in the high-AI, high-power-efficiency quadrant, as its edge-AI vision processors deliver advanced on-device analytics while consuming very little power, making them ideal for automotive, security, and IoT applications. By contrast, companies like NVIDIA offer extremely high AI capability but with significantly higher power consumption, placing them in the high-AI, low-efficiency quadrant, while firms such as Qualcomm’s older vision chips emphasize power efficiency with more limited AI functionality, and traditional image signal processor vendors fall into the low-AI, low-efficiency category.

Comments